Averages are everywhere.

If you’re weighing up taking an umbrella, the weather report will show the average likelihood of rain in an area.

Or when you’re watching football, or tennis, or cricket, the bottom of the screen is usually filled with graphics showing averages of possession, or first serves made, or runs scored.

But while averages are a useful way to simplify things, they aren’t always useful (for example, no-one in the UK has exactly 1.9 children).

And sometimes, they’re worse than useless, they’re misleading …

Famously, US Air Force Lt. Gilbert Daniels found this while trying to design a cockpit for the average US fighter pilot in the 1950’s. More than 4000 pilots had 10 key measurements taken (chest/legs/arms). And not one of the pilots matched the overall average. Some might have average arm-span, but longer or shorter legs, or a wider or thinner chest. The ‘average’ pilot simply didn’t exist!

And in finance, we see the same thing. The average year in markets doesn’t really exist.

The average return of the S&P 500 over the last 42 years is 10%. But only once in those 42 years has the actual annual return been 10% (in 2016)!

Only three other years are even within 2%; there are huge positive years, uninspiring sideways years, and terrifying negative years.

Source: Macrobond/7IM

Thus, the only way to have captured this ‘average’ return would have been to have stayed invested throughout. It’s not always possible to do this of course, there are any number of reasons why one might need to dip into one’s capital but doing so after a negative year is to be avoided……if at all possible.

It is the unpredictable nature of market returns that make proper financial planning so essential. If we build a plan based on an average investment return of say, 5% per annum, it might look great at outset but what-if the returns are delivered in the seemingly arbitrary way above? A few bad years at the beginning of the plan might mean that adjustments to spending need to be made to keep on track and similarly, if one is lucky enough to enjoy some good early years, then maybe a few extra nice holidays could be a possibility, for example. The upshot is that no financial plan can be simply, ‘fire and forget’, it must be reviewed on a regular basis.

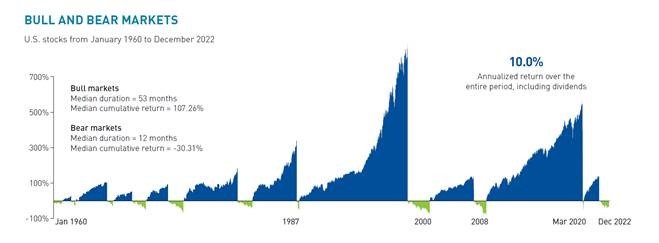

There is no doubt that we are currently in a period of uncertainty BUT, we have been through periods of uncertainty many, many times before and eventually we have come through to the other side. The following slide puts the current situation into perspective and, as we can see from the far right of the graph that as of December 2022, we were in negative territory, and we still are as of 31st August 2023, but this is not going to last forever

It is interesting that this chart covers a longer period than the previous one, 62 years, as opposed to 42 years and yet the average long-term return of the S&P 500 remains 10% per annum, which is surprising!

The key question this second chart begs is, ‘Do you want to keep your cash on the sidelines in order to avoid the green parts of the graph, or invest in a globally diversified portfolio (fully accepting that Bear Markets are going to come along from time to time), to make sure you don’t miss the blue parts of the graph? The positive periods massively outweigh the negative in both size and duration and staying invested throughout the green and the blue, is the surest way a private investor has to create wealth.

In pondering the chart above, consider the following. These are headlines from 3 different news sources I found on my iPhone this morning concerning the US stock market:

Morgan Stanley analyst predicts S&P 500 could leap another 11% this year, boosted by gains in ‘Magnificent Seven’ stocks!

After calling the S&P 500’s climb this year, this strategist says hang on, the gains aren’t over.

Stock Market Crash: S&P 500 will drop 30% or more experts warn!

The divergence of opinion here just goes to prove that NO-ONE knows what’s coming next but as a long-term investor, the chart above proves that it doesn’t matter, you should invest anyway.

Pessimists might look smart from time to time but it’s the optimists who make money!

I hope you have found this interesting but, if you have any questions about this piece or any other finance related matter, please do not hesitate to get in touch.

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner