Inflation figures have been released this morning, showing that inflation has again fallen sharply to 6.80%, as expected. This is potentially good news for mortgage holders, as it may mean an early end to interest rate hikes that we have seen over the past few months.

On the subject of inflation, I am indebted to my friends at 7IM for the following data.

If you’ve renewed your car insurance recently, you’re probably still in shock.

The Association of British Insurers found that the average price of car insurance has risen by 21% compared to this time a year ago, now coming in at more than £500 per year*. And sadly, their data isn’t on quoted prices, but on actual paid prices – i.e. after you’ve spent an hour on the phone, threatened to leave, been put through to a different department etc …

So what’s going on?

Well, the car insurance industry is basically still suffering with COVID.

Last year, insurers paid out £1.10 in damages for every £1 of premium they received. They made a loss on their car insurance business.

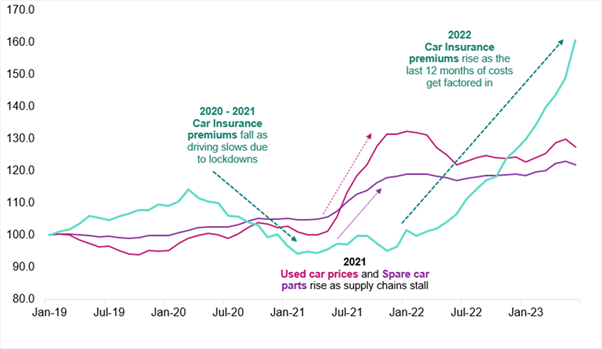

The cost of repairs was so much higher than expected, due to the increased costs of spare car parts and replacement vehicles – as the chart below shows.

UK Consumer Price Index Sub-categories

Source: 7IM/ONS. Rebased to 01/01/2019.

There have also been other cost pressures which aren’t captured in the chart – such as the cost of labour, due to car mechanics retiring or retraining during COVID, or courtesy car hire being more expensive.

It’s a great illustration of why inflation is so difficult to get under control, and for central banks to predict. So many moving parts (literally so in this case), and with such long lags before the impact is felt:

The world locked down over three years ago …

So, supply chains were struggling two years ago …

So, used car prices shot up 18 months ago …

So, car insurance companies made losses over the last 12 months …

And so, your insurance premium is rising this year.

Economic textbooks always make things sound so straightforward; the reality of why prices go up (or down) is always far more complicated.

As you know, I do like to try and end these missives on a positive note. The following short video (4 mins) provides such a tone. The speaker is Steven Bell, Chief Economist at Columbia Threadneedle. To watch the video, after you have followed the link, you will need to agree to proceed as an intermediary. This is a compliance issue to protect Columbia Threadneedle, however, I have viewed the video carefully and there is nothing in it which is likely to lead to any client making a poor decision.

I hope you have found this interesting but, if you have any questions about this piece or any other finance related matter, please do not hesitate to get in touch.

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner