I am most anxious not to inundate you with information during the Coronavirus outbreak but I feel sure the occasional update will be well received. It is my intention to provide such updates each week as the situation develops, for the time being.

The following is a blog post from yesterday by Alistair Meadows of EBI Investments Ltd. It is EBI who construct our investment portfolios.

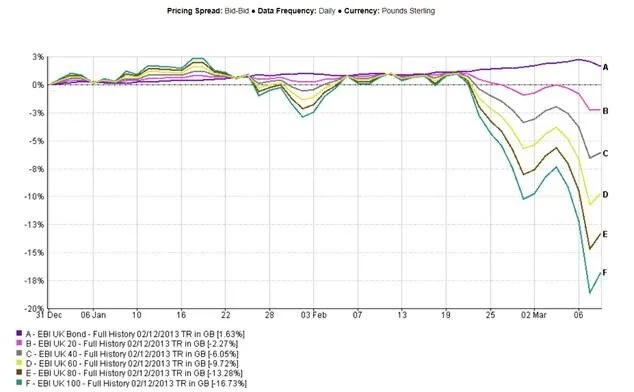

“As unexpected shocks go, Coronavirus ranks in the very top tier of events capable of disconcerting investors, amongst the Great Financial Crisis (GFC) and Black Monday. Whilst news continues to horrify many investors with the human and economic implications, buried in the latest data in what statisticians refer to as “the inflection point of a logistics curve”, is a sign that the very worst may be over.

February news was dominated by the global spread and impact of the Coronavirus (Covid-19). Dow Jones, S&P 500 and the FTSE All-Share fell by over 14%, 12% and 11%. So far in March (16th March 2020), these Index markets have been continuing their decline and the correction has now developed into a full-scale bear market.

The first wave of market declines was influenced by two drivers: The world supply chain being compromised and the closure of much of China’s businesses. China is responsible for approximately 16% of World GDP and 35% of World GDP Growth.

Commodities (raw materials; sugar, rice etc) have also felt the impact of the virus. Unsurprisingly, the impact is increased when looking at the products China heavily consumes. Raw materials price declines have a shockwave effect to export dependent countries; Brazil, Chile and Peru have high export trade as a proportion of their GDP (approximately 29%, 59% and 49% respectively). All will be feeling the pinch.

The second wave has been primarily driven by one factor; failure to contain the virus globally, leading to the coronavirus being declared a pandemic by WHO (World Health Organisation), with Europe now as its epicentre.

The severity within Europe has caused some countries to shut down, imposing country-wide lockdowns, border closures and curfews to control the virus. Countries like Italy, Spain and Germany now have more active cases of the coronavirus than China.

As coronavirus spread to North America, the Federal Reserve cut interest rates to zero and launched a $700bn stimulus programme in a bid to protect the economy from the effects of coronavirus.

The consensus for the short run is that the situation is most likely going to get worse before it gets any better. The credit rating agency Standard and Poor (S&P) stated "The initial data from China suggests that its economy was hit far harder than projected, though a tentative stabilisation has begun…Europe and the United States are following a similar path, as increasing restrictions on person-to-person contacts presage a demand collapse that will take activity sharply lower in the second quarter before a recovery begins later in the year."

Nevertheless, amongst the bad times of late around the globe there are now some positives. The high levels of quarantine measures taken in China are easing and the President is urging China’s inactive workforce to now return to work. Additionally, the realisation that global slowdown in supplies hasn’t affected domestic consumer prices yet, which is a positive. China’s experience serves a model of how the rest of the world can control coronavirus, locking down and quarantining huge sections and building hospitals to increase capacity appears to be working.

In addition, new academic analysis of the infections data suggests that for Italy, the shape of the graph’s curve of is forming what statisticians refer to a logistics or “S” shaped curve, changing the shape away from the exponential “J” shaped curve so the current state forms an inflection point. This demonstrates the success of the lockdown model.

We are also now universally seeing all countries taking drastic measures to help stop the spread of coronavirus and providing economic stimulus to help the economy deal with the effects of the outbreak, for example, the US and the UK have provided emergency rate cuts and countries are starting to provide economic stimulus.

As hard as it may seem, fear and panic should not be allowed to drive investment decisions. In general, it’s good to remember that any losses incurred are only realised if you sell. The idea that markets go up and down and don’t show a continuous level of performance is no surprise.

Remember, EBI Portfolios’ all-weather investment philosophy offers a long-term investment solution suitable for any market regime or circumstances, so it should be no surprise we are focusing on the long term. Unless you believe that capitalism will be brought down by a virus, this most likely is just another bout of selling that will lead to buying again.

Please note that the value of investments and the income derived from them may fall and you may get back less than you invested. Past performance is not a guide to future performance.”

As always, if you have any questions concerning this e-mail or any other finance related matter, please do feel to contact me at any time.

With kind regards,

Yours sincerely

Graham Ponting CFP Chartered MCSI

Managing Partner