I know many of you will be more than a little concerned about the fast developing coronavirus situation, not just from a health perspective but also from the point of view, how is market turbulence affecting your investments?

Probably the best way to answer this question is to take a look at the following 2 charts:

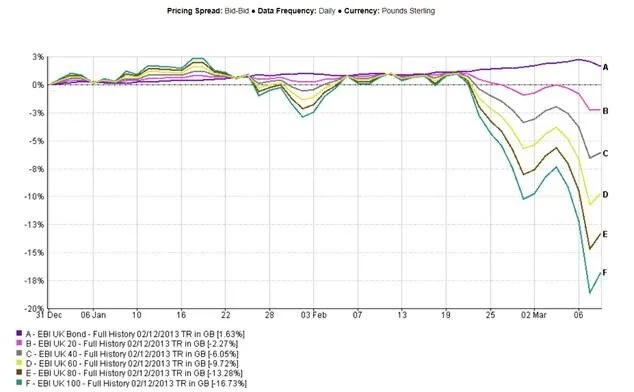

This first chart shows how our lowest risk portfolio (EBI UK Bond) has performed since 1st January when compared with our highest risk portfolio (EBI UK 100). The dramatic difference in fortunes is plain to see, with the Bond portfolio actually increasing through most of this coronavirus scare (well, so far at least).

We will look at a wider range of the portfolios below but please remember each portfolio contains an element of the Bond portfolio and the 100 portfolio. As an example, EBI UK 60 is essentially 60% of the 100 portfolio, blended with 40% of the Bond portfolio, and so on.

This second chart shows how a higher exposure to Bonds has cushioned some of the portfolios from recent falls.

My advice remains resolutely that, unless our clients are in dire need of funds, they should attempt to ride out what is likely to be a painful but temporary downturn and NOT to disinvest at this time. However, if you feel you have no alternative, it will be possible to take money just from the Bond element of the portfolios, thus not selling equities (shares) when it is clearly not sensible to do so. This will change the balance of what remains in the portfolio to higher risk but this can be addressed by a ‘rebalance’ when markets recover.

If this is something you feel you need to do, please contact Adam and he will advise you how to go about this.

Serious though this situation undoubtedly is, now is the time to put on one’s tin hat and hide behind the sofa, until things improve.

As always, if you have any questions concerning this e-mail or any other finance related matter, please do feel to contact me at any time.

With kind regards,

Yours sincerely

Graham Ponting CFP Chartered MCSI

Managing Partner