I am a great fan of a man called Nick Murray, a Financial Adviser in the US, and what follows are a few of his beliefs around investing. I subscribe to these views 100%!

I thought you might find these pearls of wisdom reassuring while markets seem to be going through a turbulent period.

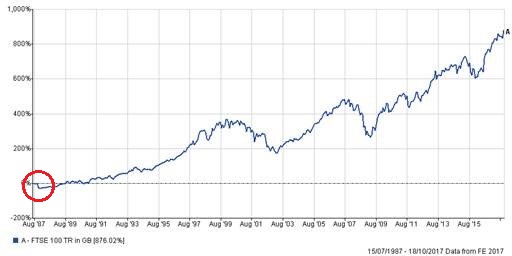

I believe that the great long-term risk of stocks is not owning them

On July 8, 1932, the intra-day low of the Dow Jones Industrial Average was 40. On October 14, 1996, the Dow closed over 6000. The intervening period was the worst in human history: Depression, WWII, Cold War etc. However anecdotally, I infer from these data three things. The right time to buy stocks is now (as long as you have the money); the right time to sell them is never (unless you need the money); the great risk is not owning them. Incidentally the Dow Jones, even after recent setbacks, sits at around 25,000.

I believe that everything you need to know about the movement of stock prices can be summed up in eight words: the downs are temporary; the ups are permanent.

I never mistake fluctuation for loss. Share prices go down all the time – 25% or so on an average of every five years (albeit not lately) – but since they never stay down, it turns out not to matter. Markets fluctuate but do not create losses. Only people can create permanent loss by mistaking a temporary decline for a permanent decline, and panicking out. No panic, no sell. No sell, no lose. The enemy of investment success is not ignorance, it’s fear. So, it’s my faith, not my knowledge that saves the investor’s financial life.

I process the experience which most people describe as a ‘Bear Market’ in two different words; BIG SALE!

Since all declines are temporary, I regard all major generalised equity price declines as an opportunity to stock up on some more truly safe investments before the sale ends.

I don’t believe in individual stocks, I believe in managed portfolios of stocks

I can break a pencil; I cannot break 50 pencils tied together. That’s diversification. Thus, one stock can go to zero but stocks as an asset class can’t go to zero.

I believe that dollar-cost averaging (making regular investments over a long-period of time) will make the dumbest person in the world wealthy. Hey, look at me; it already has!

The more ‘knowledge’ you have the more you try to outsmart the market, and the worse you do. The more you see the market as long-term inevitable/short-term unknowable, the more you’re inclined to just dollar-cost average and the better you do. Dollar-cost averaging rewards ignorance with wealth.

I love volatility

Volatility can’t hurt me because I am immune to panic. And, it can help me in a couple of ways. First, in an efficient market, higher volatility means (and is the price of) higher returns. Second, higher volatility when I’m dollar-cost averaging means even higher returns. Higher returns are good. Trust me on this.

I’m not afraid of being in the next 25% downtick. I’m afraid of missing the next 100% uptick!

And I’ve noticed that I have no ability whatever to time the markets. Still, I have found a way to machine the risk of missing the next 100% uptick down to zero. It’s called staying fully invested all the bloody time. Works for me.

I believe that prior to retirement, people should own as close to 100% equities as they can emotionally stand. Then, after retirement, I believe they should own as close to 100% equities as they can emotionally stand.

If it follows that stocks will always rise (eventually), then the above has to be true. Whether your emotions can stand it is perhaps a different matter. Many would happily sacrifice some of those higher returns for a good night’s sleep.

If you have any concerns about market gyrations over the coming weeks and months, just come back to this and every time you get an attack of the jitters (we all do, even me); keep rereading it

As always, if you have any concerns about your own financial arrangements and whether you are truly making the most of your money, please do not hesitate to call me.

With kind regards,

Yours sincerely