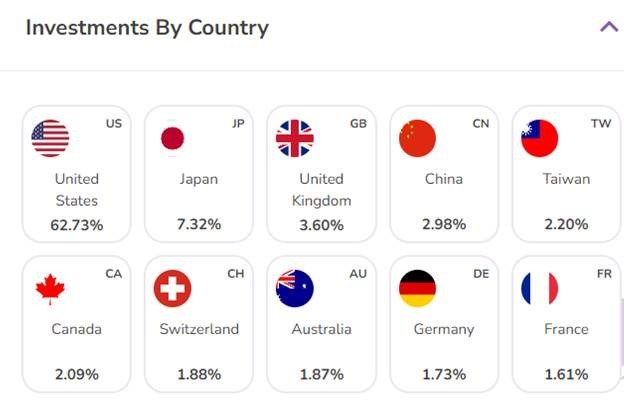

As you know, our portfolios are heavily weighted towards the US and I have often said that a decent indicator of direction of travel of our portfolios would probably be the S&P 500, as opposed to say, the FTSE 100, for that reason. The equity content of the ebi portfolios is currently spread as follows, with smaller amounts allocated to many other countries (not Russia, I hasten to add).

However, a number of clients have observed that their portfolios do not currently seem to be following the S&P 500 in any reliable way, and I do agree. There is a reason for this, and I hope what follows will shed some light on the genuinely extraordinary circumstances that have led to this situation.

In brief summary, it is to do with the Sterling/US Dollar exchange rate. Assets held in the US will have a higher value in the UK when Sterling is weak (the dollar value buys more pounds) and of course vice versa. As Sterling strengthens, the dollar value of US held assets declines. In normal circumstances these fluctuations are generally small and are accepted as part of owning an internationally diversified portfolio. However, the following chart shows the unusually volatile situation with the exchange rate over the past 2 years.

According to the interactive version of this chart, which can be found at https://www.xe.com/currencycharts/?from=GBP&to=USD&view=2Y, the Sterling/US Dollar exchange rate on 1st Jan 2022 was $1.35289 but by 27th September, this had fallen to $1.07687, a drop of 20.40%. Part of the reason for the extreme dip in September was of course, Kwasi Kwarteng’s disastrous mini-Budget which significantly undermined confidence in the UK but, the general decline in Sterling had already begun long before this, as the US Federal Reserve began increasing interest rates in response to rising inflation in the States, making the Dollar relatively more attractive to investors than Sterling.

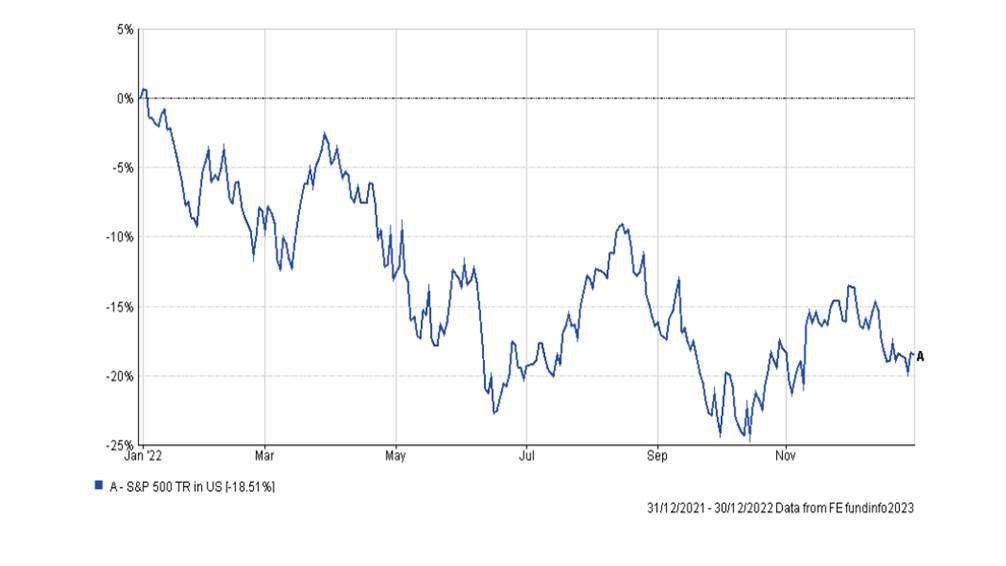

There was however, some good news in Sterling’s weakness for clients last year, not that it necessarily felt like it. This was because when the S&P 500 fell by 18.51% between 1st Jan 2022 and 31st December 2022, UK investors only suffered a drop in value of their US investments of 8.25%. See charts below:

S&P 500 in US Dollar terms

S&P 500 in Sterling terms

Thus, our clients were shielded from a significant part of the turmoil in the US by weakening Sterling. It didn’t feel like much of a victory because, let’s face it, an 8.25% fall is still a significant loss. Nevertheless, our portfolios not mirroring the S&P 500 last year was a good thing.

As inflation in the US has been falling (it is down at somewhere around 3.0% now), the currency markets are now betting on US interest rates being cut in the relatively near future. In the UK however, we are expecting the numbers to show tomorrow that inflation has remained stubbornly high. If that is indeed the case, then it is likely that interest rates in the UK will go higher and remain high for longer – this is good news for Sterling and we can see that the US Dollar exchange rate has now recovered by 21.47% to $1.30803, as of yesterday. The problem with this increase in the value of Sterling is that it has diluted the recovery we have seen in the S&P 500 since the start of the year. The following charts show the S&P 500 in Dollar and Sterling terms since the start of the year:

S&P 500 in US Dollar terms – 1st Jan 2023 to 17th July 2023

S&P 500 in Sterling terms – 1st Jan 2023 to 17th July 2023

These charts show that the S&P 500 has grown by 18.87% since the beginning of the year in Dollar terms but in Sterling terms, only by 9.30%. Thus, UK investors have benefited from just 50.71% of the rise in the US since Jan.

An added complication in all of this has been the impact on Bond Markets of sharply rising interest rates. The capital value of a Fixed Income investment (Bonds and Gilts etc.) will fall as interest rates rise, because the fixed income attaching to the Bond becomes relatively less attractive. The portfolios of the majority of our clients have been affected by this, depending on the level of Bond exposure. The following chart compares the ebi Global Bond exposure to just UK Bonds in the form of Gilts from 31st December 2021 to 17th July 2023:

Many investment managers with a UK bias have suffered particularly badly during the course of the last 18 months because of the above. High risk clients expect extreme volatility from time to time but medium risk investors less so.

An additional issue a couple of clients have raised with me is whether they might be better investing in the UK say, in the FTSE 100. However, an earlier blog I issued in March details why most funds now eschew the UK in favour of the US. The performance of the UK was good last year, because of the energy crisis (the FTSE is largely made up of oil, gas and miners) but looking forward, this is not likely to be sustainable. The following chart shows the S&P 500 vs FTSE 100 over the last 20 years in Sterling terms:

With almost all major tech companies listed in the US and with the advent of AI, our view is that this gap in performance is likely to persist, hence our weighting to the US.

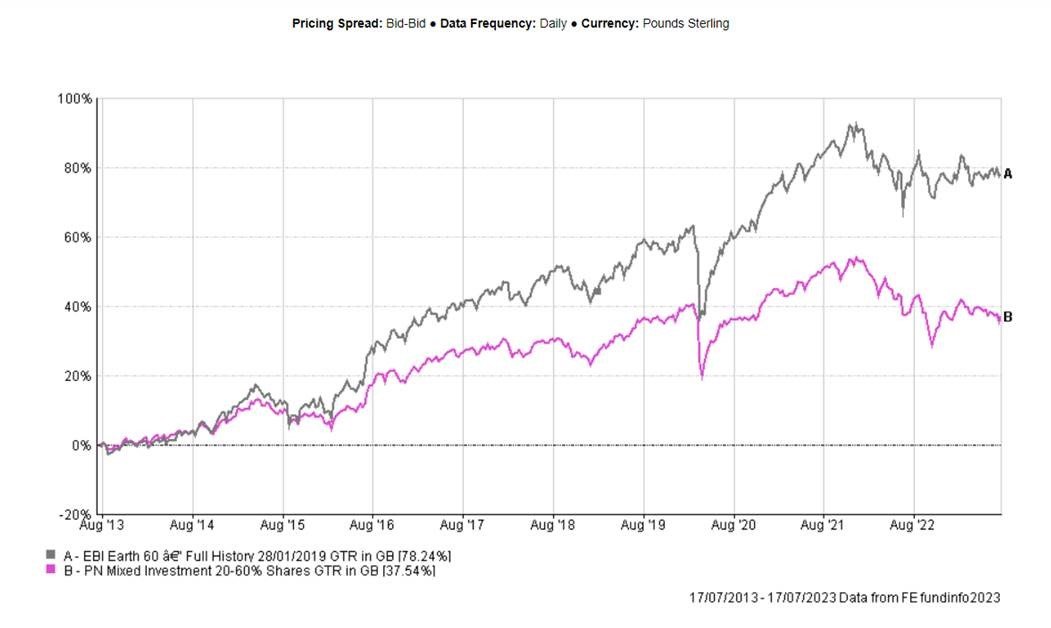

The final point I would like to make is that although performance has been disappointing for all of us over the past 18 months or so, ebi have still outperformed the sector averages, confirming that all fund managers are finding these market conditions challenging. The only thing we can do is have faith that all of the headwinds we are facing will eventually pass…….as they always have in the past.

This next chart shows the performance of portfolio Vantage Earth 60 (our most popular portfolio) over the past 18 months against the appropriate sector average (the sector contains 575 funds):

As I am keen to finish on a positive note, this final chart shows Vantage Earth 60 (simulated returns), against the sector average over the past 10 years.

I hope you have found this interesting but, if you have any questions about this piece or any other finance related matter, please do not hesitate to get in touch.

Yours sincerely,

Graham Ponting CFP Chartered MCSI

Managing Partner