This is not a text heavy diatribe, just a few charts to give you a sense of how the Clearwater Portfolios have been faring during this period of unprecedented uncertainty. I have shown a range of Portfolios over 6 Months, 1 Year, 5 years and 20 Years.

6 Months to 10th December 2018

1 Year to 10th December 2018

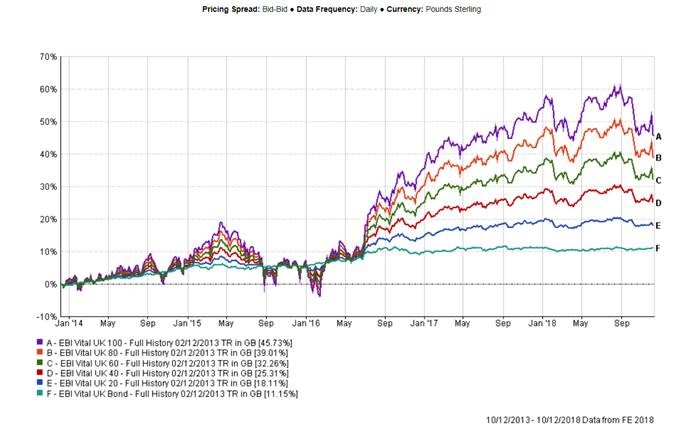

5 Years to 10th December 2018

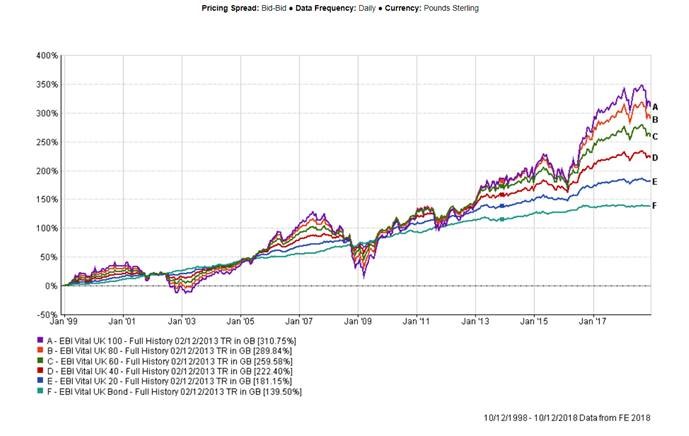

20 Years to 10th December 2018

The final chart shows our 2 most popular Portfolios, EBIP 40 and EBIP 60 plotted against the FTSE 100 Index over the past 12 months; I have included this to provide a sense of comparative volatility. I think this chart underlines the benefits of global diversification, in terms of reducing volatility.

1 Year to 10th December 2018 – FTSE 100 vs EBIP 40 & EBIP 60

What I hope you will take from this e-mail is a sense that, although we are sailing on choppy seas at present, when set against the longer-term backdrop this type of volatility is quite normal. It’s always something different that causes the volatility but this is quite healthy with efficient markets and we have seen it all before.

It is entirely possible that markets will fall further before they stabilise but this might present buying opportunities for investors holding cash. I don’t believe in market timing of course but if markets are cheaper than they were previously, now must be a better time to buy.

As always, if you have any questions on this subject or indeed on any other finance related matter, please do not hesitate to call me.

With kind regards,

Yours sincerely

Graham Ponting CFP Chartered MCSI

Managing Partner